Get the Full ERT Credits You Are Eligible for Without the Hassle

Small Business ERTC Help

Employee Retention Tax Credit (ERTC) helps employers whose businesses are negatively affected by COVID-19 to keep employees on their payroll.

Let us help to determine if you are eligible for ERTC. If you are eligible, we will handle the paperwork and filing process to the IRS.

There is no risk to you! We only charge a percentage of what is found during the ERTC process. Save time and don’t pay out of pocket with our tax refund services.

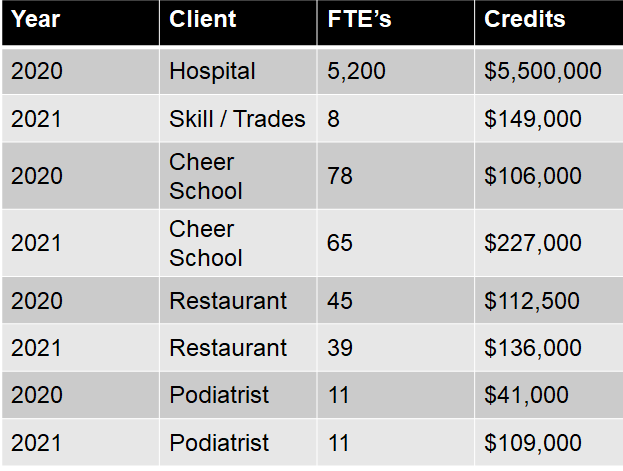

We have processed more than $35M in credits and are not a “fly by night” company. We have served hundreds of small to medium sized businesses across the country for nearly a decade. Let us help you!

Check out some of our recent success stories!

How Our ERTC Process Works

Discovery Session to Determine Eligibility

Discovery Session to Determine Eligibility

Our team will work with you to determine if you are eligible for ERTC and go through next steps.

Amend Returns & Recieve Your Payment

Amend Returns & Recieve Your Payment

We will submit the necessary forms. The IRS will send your tax refund check in the mail.

Employee Retention Tax Credit (ERTC) Questions

There are different eligibility criteria for 2020 and 2021. Many businesses are eligible based on government shutdown orders but there are also criteria around reduction in top-line revenue. We will help you quickly determine if you are eligible in 15 minutes on the phone!

We can determine eligibility and have your certified reports submitted to the IRS within a couple of weeks. We will go as fast as you will!

Let’s start by chatting to determine if you are eligible. If you are eligible, you can e-sign our engagement letter and we will get to work on your behalf.

Great question! We have processed over $35M in ERT Credits. We are also not going anywhere. We are seeing many companies offer this that might not be around in a few years if you get audited. We have moved over $1B in payroll taxes and we aren’t going anywhere!

Discovery Session to Determine Eligibility

Discovery Session to Determine Eligibility

Gather Information to Certify the Tax Credits

Gather Information to Certify the Tax Credits Amend Returns & Recieve Your Payment

Amend Returns & Recieve Your Payment